A Thief in the Night: Nobody is Safe

A common technique used by some thieves to steal one’s card information; simply looking over one’s shoulder.

Picture this: It is a Friday, paycheck just came in, it is the cash needed for some relaxation time at the mall, the movies, or a restaurant. Nothing seems to be stopping the “burning hole” in that pocket of a heavy spender. When that card gets swiped and a “DECLINED” message pops up, the Friday spending high is gone and a cringing look fills the face of the spender who thought there was an abundance of cash on that debit card. While looking through the card statement, it seems that someone else was “balling” that night too.

Identity theft is a “crime in which an imposter obtains key pieces of personally identifiable information, such as Social Security or driver’s license numbers, in order to impersonate someone else,¨ (Identity Theft Recovery). However, there are plenty of signs to help people identify when theft occurs and there are also useful tips provided to help people protect their identities.

For example, the Federal Trade Commision (FTC) provides a “one-stop resource for identity theft victims,” as stated on the website. The website offers steps necessary when someone becomes a victim of identity theft. The three steps are: “Tell us what happened, get a recovery plan, and put your plan in action.” At the end of that process, victims should be relieved of some stress, but do not think for one second that it will never happen again.

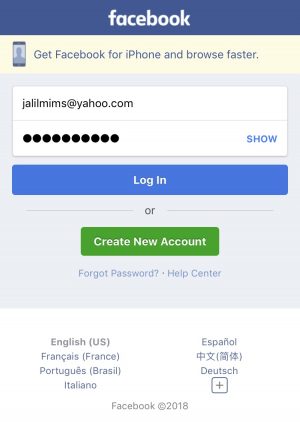

Sharing passwords to friends gives easy access to potential theft.

To keep individuals protected from this criminal activity, identity theft victims or people who fear it can follow some of these tips. For one thing, and this should be common sense, never, under any circumstances, share passwords, emails, or online data with anyone else. That is one of the most common mistakes many people make. Many people are casual with providing such information due to the fact that some people think they can trust one another with their own, private information. Another cause of identity theft is the access of janky websites. Certain sites can be created or hosted by “online predators” who can access accounts and personal information just by the click of a button (or rather just the click of the web surfer). One must make sure to only visit safe and secure websites that have protection against malware, viruses, or anything hackers use to gain access to other people’s personal information.

Anyone, even with the highest amount of security on their personal information, can have their identity stolen. It will be no surprise if someone tries to purchase an item at a store also gets hacked. No one knows exactly how, when, or where the thief will strike but, it is always important to be on the lookout when getting into activities such as mobile banking, purchasing from uncertified websites, and making purchases at a grocery store; however, the most known cases of identity theft has been found within grocery stores.

Facebook users are very susceptible to being hacked, such as in 2011 when it was found that up to 600,000 “users” are fake accounts.

“Though it has the chance to happen to me, I haven’t been hacked on any of my social media or bank accounts. Some people don’t know that sharing just one piece of personal information can lead to all of your stuff being finessed,” said junior Luke Guzik.

As this epidemic remains prevalent in countries all across the world, the U.S. government has created a new solution that should keep some Medicare patients from having their social security numbers stolen. As of May 18, 2018, the new solution to this problem consists of sending out brand new Medicare cards to San Joaquin Valley residents.

“The new cards will display a random set of 11 characters of numbers and letters, and should help deter identity theft and Medicare fraud,” said Barbara Anderson from FresnoBee.com.

In essence, it will be nearly impossible for thieves to collect one’s identification information like bills, credit cards, and social media accounts. The system placed in San Joaquin Valley should be the same system placed throughout the United States to decrease the chances of theft occurring.

Until the government discovers a way to implement a this system to prevent most identity theft cases, people all over will have to take matters in their own hands by checking all necessary financial accounts, keeping information for logins of apps and websites secret, and to always remain cautious when making online or in-store purchases. If the card-owner is not spending, someone else is!